2025 Benefits

We care about the health, wellbeing and financial security of our associates and we are proud to offer a comprehensive benefits program to all employees. Your benefits are an important part of your total compensation, therefore, we invite you to familiarize yourself with the details of these plans.

Employee Benefits Guide

Your Medical Benefits

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage thirty days from your hire date.

How to enroll:

To enroll, employees must submit the benefits and payroll deduction authorization form to Human Resources. This form is located under the Benefits Enrollment Form section on this page. As a new hire, you have 30 days to enroll or waive coverage. If you miss the new hire enrollment window, you must wait until the next open enrollment session to enroll in benefits unless you experience a qualifying life event.

What happens if I leave Douglas Toys?

Under certain circumstances, you and your dependents may continue to participate in health coverage, dental insurance, and the Medical Flexible Spending Account through the Consolidated Omnibus Budget Reconciliation Act (COBRA). COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends. It allows you to remain on medical and dental coverage at your own expense for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums. Your dependents may continue participating in health coverage and dental insurance through the Consolidated Omnibus Budget Reconciliation Act. COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends, which allows you to remain on medical and dental coverage, at the employee’s expense, for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums

Summary of Benefits & Coverage

Summary of Benefits

Certificate of Coverage (COC)

Anthem

Member Services

Phone: (800) 331-1476 | Website: http://www.anthem.com

Medical Contribution Schedule

| 2025 Employee Weekly Paycheck Deduction | ||

|---|---|---|

| Coverage Level | Anthem Access Blue NE HMO SOS | Anthem Access Blue NE 4000 HSA |

| Employee Only | $21.90 | $8.15 |

| Employee + Spouse | $48.60 | $18.08 |

| Employee + Child(ren) | $44.24 | $16.46 |

| Family | $66.58 | $24.77 |

Benefit Enrollment Form

Pharmacy/RX Information

Make the most of Anthem’s pharmacy information by searching your plan’s drug list, locating a pharmacy, and learning about medication costs. Click here to be directed to Anthem’s Pharmacy Page for members

Helpful Resources

Your Health Savings Account Benefit

What is a Health Savings Account (HSA)?

HSAs are tax-advantaged member-owned accounts that let you save pre-tax* dollars for future qualified medical expenses. You can invest** HSAs—and funds never expire.

HSAs allow you to take advantage of triple-tax savings.*

- Make pre-tax payroll contributions

- Grow tax-free earnings

- Enjoy tax-free distributions for qualified medical expenses

*HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible, with very few exceptions. Please consult a tax advisor regarding your state’s specific rules.

**Investments are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. Investing may not be suitable for everyone, so before making any investments, review the fund’s prospectus.

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage thirty days from your hire date. To be eligible for a Health Savings account, you must be enrolled in Douglas’s Anthem Access Blue NE HMO HSA plan

How to enroll:

Employees must submit the Health Savings Account Enrollment form located under Benefit Forms on this page to Human Resources.

As a new hire, you have 30 days to enroll or waive coverage. If you miss the new hire enrollment window, you must wait until the next open enrollment session to enroll in benefits unless you experience a qualifying life event.

When are HSA funds available?

Your Health Savings Account (HSA) funds are available as you make contributions. You can set up monthly recurring payments, as well as make additional payments to your HSA until you have met the yearly contribution limit.

What happens if I leave Douglas Toys?

HSA funds rollover and are always your funds to keep. With a Health Savings Account (HSA), you can take your healthcare nest egg with you wherever your career takes you.

Your HSA is yours to keep, even if you change jobs, switch healthcare plans, or retire.

If you lose your job and elect to retain your high-deductible health plan under COBRA, you may even pay the COBRA premiums from your HSA.

The money in your account always rolls over year to year—there’s no “use it or lose it” risk.

Health Equity

Member Services

Phone: (866) 346-5800 | Website: http://www.healthequity.com

Benefit Forms

Helpful Resources

HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Health Spending Account.

Did you know you could use your HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

Your Dental Benefits

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage thirty days from your hire date.

How to enroll:

To enroll, employees must submit the benefits and payroll deduction authorization form to Human Resources. As a new hire, you have 30 days to enroll or waive coverage. If you miss the new hire enrollment window, you must wait until the next open enrollment session to enroll in benefits unless you experience a qualifying life event.

Dental Summary of Coverage

Helpful Resources

Delta Dental

Member Services

Phone: (800) 832-5700 | Website: https://www.nedelta.com/patients/

Dental Contribution Schedule

| 2024 Employee Weekly Paycheck Deduction | |

|---|---|

| Dental Coverage | Employee Weekly Cost |

| Employee Only | $4.14 |

| Employee + 1 | $7.55 |

| Employee + Family | $12.85 |

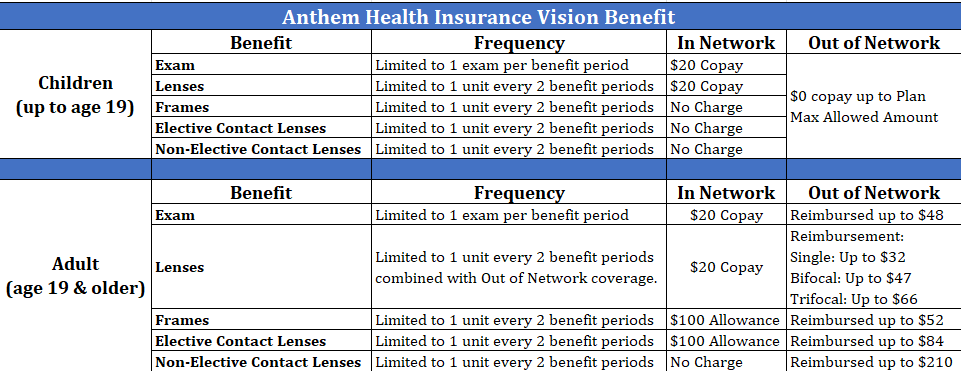

Your Vision Benefits

Eligibility:

All full-time employees who work at least thirty hours per week are eligible for coverage thirty days from your hire date. You must be enrolled in the medical plan to take advantage of the vision benefit.

Anthem

Member Services

Phone: (800) 331-1476 | Website: http://www.anthem.com

Contribution Schedule:

Your vision benefit is included in the cost of your medical weekly payroll deductions.

Helpful Resources

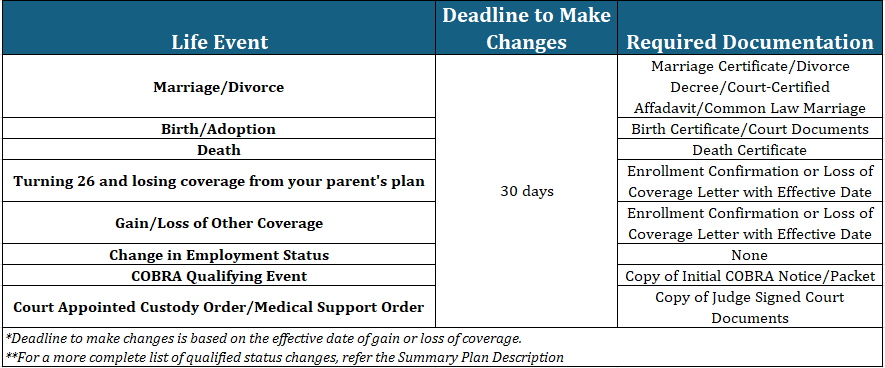

What is a Qualifying Life Event?

At times, life takes unexpected turns. During such times, changes may happen outside of the regular new hire or annual open enrollment period. These qualifying events (QLE) allow you to enroll or cancel coverage outside of the regular enrollment period. QLE events commonly include, but are not limited to:

Employees must notify Human Resources and submit the required documentation for your qualifying life event. If you miss the QLE window, you will have to wait until the next open enrollment period to enroll and/or drop coverage.

Qualifying Life Event Example:

- Life Event: Marriage

- Marriage Date: 6/1

- Deadline to enroll/drop Coverage: 6/30

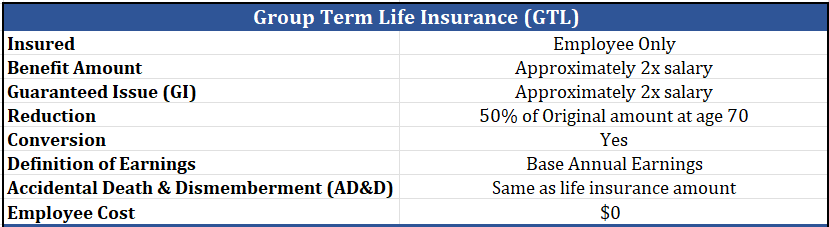

Your Group Life Benefits

Equitable

Member Services

(800) 777-6510 | Website: http://www.equitable.com

Contribution Schedule

Your Group Life Insurance plan is covered 100% by the company.

Benefit Forms

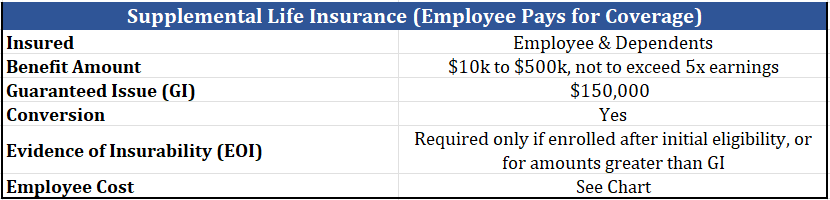

Your Voluntary Supplemental Life Benefits

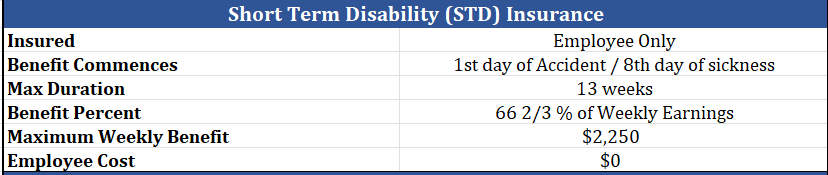

Your Short Term Disability Benefits

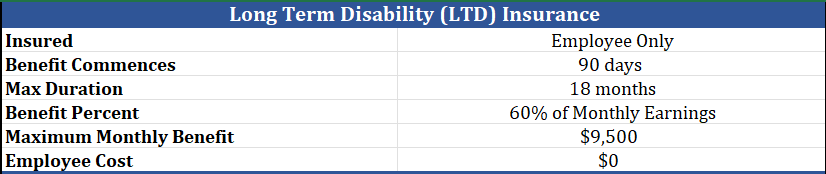

Your Long Term Disability Benefits

SmartConnect: Your Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

Eligibility:

This benefit is available to all employees of Douglas Toys.

Helpful Resources

Member Services

Phone: (833) 502-2747 | TTY: 711

Website: http://gps.smartmatch.com/therichardsgroup

Hours: Monday – Friday 7:30 a.m. – 5:00 p.m. CT

Your Employee Assistance Program

Employee Assistance Program:

Douglas promotes the health of employees and their household members by offering immediate access to free, confidential resources through Equitable/ComPsych for a wide range of life issues. ComPsych provides support for overall health, well-being and life management, the EAP can assist employees and their household members with issues such as everyday stress, grief & loss, legal questions, financial concerns and relationship issues at work or home. EAP benefits are 100% confidential and available to all employees and their household family members.

Why do people call us?

▪ Confidential emotional support (i.e. Grief, Loss, Anxiety, Depression, etc…)

▪ Work-life Solutions (i.e. finding childcar/elder care, planning events, etc..)

▪ Identity theft services

▪ Financial Resources (i.e. retirement planning, taxes, budgeting, etc…)

▪ Legal Guidance: Free 30 minute consultation and a 25% reduction in fees

▪Online will preperation

▪ …And support for anything else that’s on your mind!

Equitable/ComPsych

Employee Assistance Program available for 24/7 support, resources and information.

Call: (833) 256-5115 | TDD: (800) 697-0353

Website: https://www.guidanceresources.com/groWeb/login/login.xhtml

WebID: EQUITABLE3

Helpful Resources

My Tuition Assistance Benefits

Our tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefits program revolutionizing how employees can reduce their student loan debt.

GradFin will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

- For more information or to schedule a one-on-one consultation visit: http://www.gradfin.com/platform/trg

Phone: (844) GRADFIN

Website: http://www.gradfin.com/platform/trg

The Wellness Outlet

We offer our employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

Website: https://www.thewellnessoutlet.com/